Renters Insurance in and around Oak Forest

Welcome, home & apartment renters of Oak Forest!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - furnishings, size, number of bedrooms, townhome or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Welcome, home & apartment renters of Oak Forest!

Renting a home? Insure what you own.

There's No Place Like Home

When the unpredicted accident happens to your rented condo or space, generally it affects your personal belongings, such as a tablet, a TV or a desk. That's where your renters insurance comes in. State Farm agent Brian Robinson is dedicated to help you choose the right policy so that you can protect yourself from the unexpected.

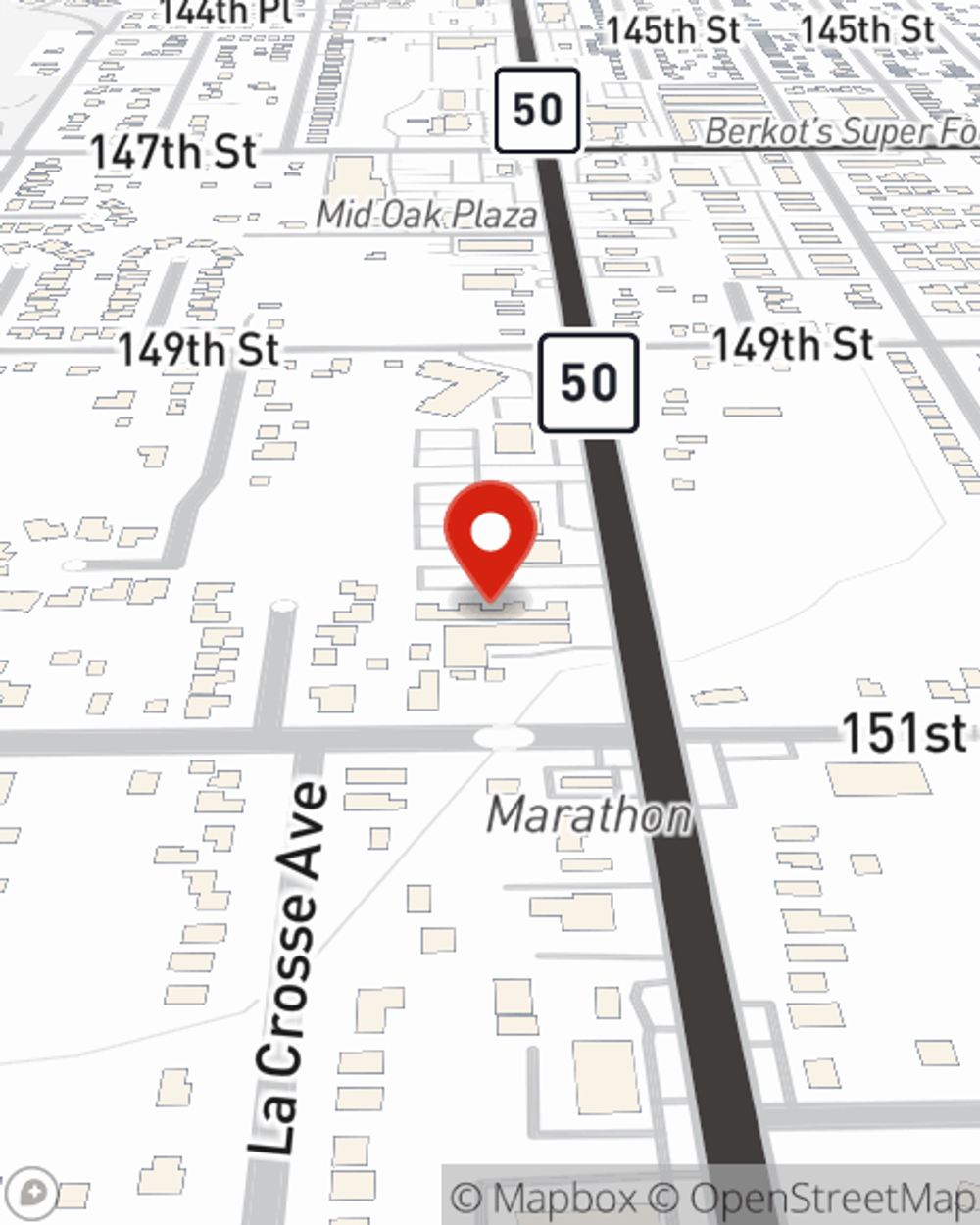

It's never a bad idea to be prepared. Get in touch with State Farm agent Brian Robinson for help getting started on options for your policy for your rented unit.

Have More Questions About Renters Insurance?

Call Brian at (708) 687-8585 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Brian Robinson

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.